All your Japan marketing efforts have led to the point of sale, and now it’s time for customers to check out. But for some reason, you’re experiencing frequent cart abandonment. If you’re not offering the right payment options, your Japanese eCommerce strategy is all for naught.

In This Article

Today, we’ll explain how the Japanese population shops and pays online, and how you can optimize options to complete the conversion.

Why That “Place Order” Button Is Like Pulling Teeth

If you’ve been following along with our blog, you probably know the checklist of points to hit for positioning yourself in the Japanese market. You can localize content and UX, and run highly targeted ads—basically do everything right. It still might not be enough, however, as cart abandonment remains a silent killer.

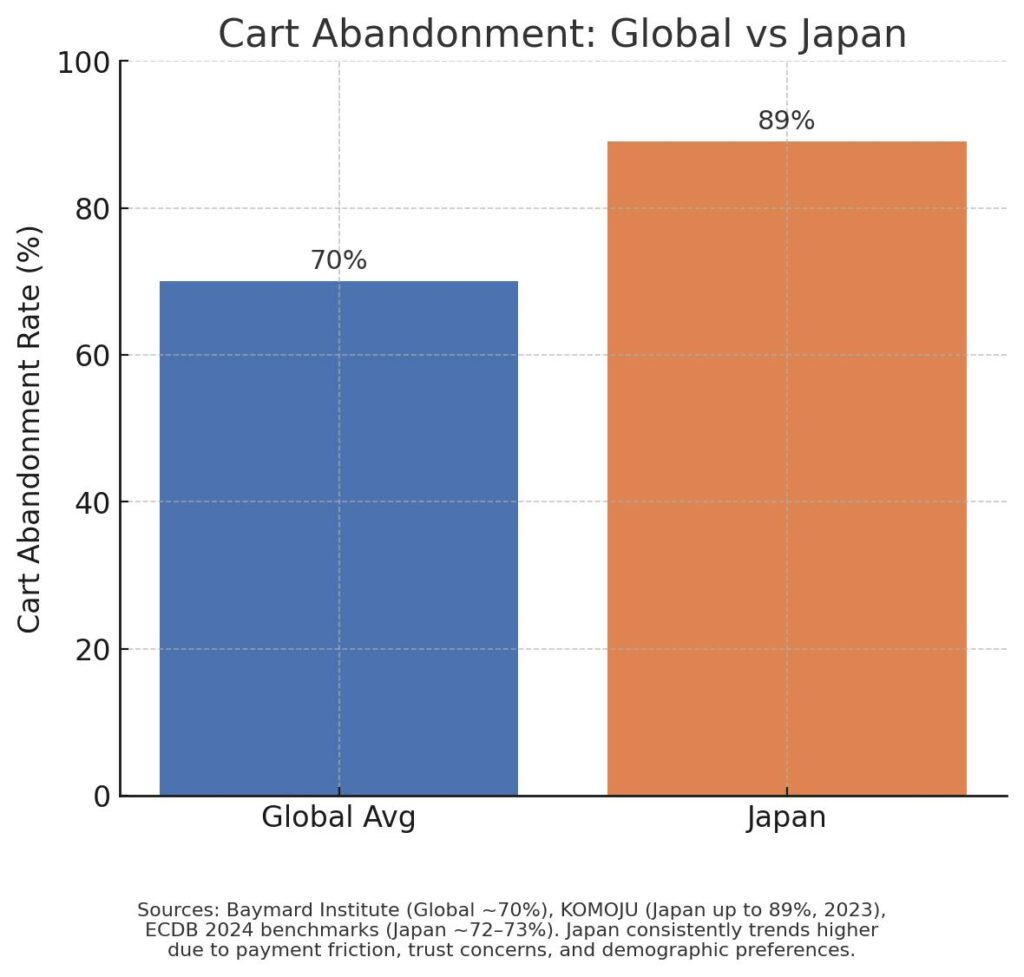

Some Eye-Watering Stats

The average global cart abandonment rate is around 70%. That’s high enough as it is, yet Japan’s abandonment rate exceeds that, with some sources suggesting it could be north of 80%.

Any number of factors can influence these abandonment rates, but misaligning your payment options is certainly one, and can potentially cost a brand tens or hundreds of thousands of dollars in lost revenue.

Japanese eCommerce Payment Culture: Available Options

For better or worse, Japan had long been stuck as a cash-first society. At the turn of the 2020s, the country saw an explosion of payment offerings, expanding to digital at break-neck speed.

Here’s a rundown of the most popular payment options in Japan.

Cash and Konbini Payments

Digital adoption has accelerated, but the aging Japanese population is still strongly cash-oriented. Older demographics prefer tangible payment options. This stems from cultural risk aversion, which trickles down to younger generations as well.

A 2023 study revealed about 42% of online shoppers ages 15-19 used “konbini payments” that allow them to pay for online orders at convenience stores.

E-Commerce giants Amazon and Rakuten offer both cash-on-delivery and konbini payment options in Japan to gain trust and positive familiarity among Japanese consumers.

Credit Card Payments

Credit cards are still the leading cashless payment by far. This can be tricky for Japanese eCommerce, however, for a couple reasons. First, many Japanese consumers prefer to pay in installments (分割払い), which is a standard option provided by credit card companies in Japan.

Secondly, echoing the risk aversion issue, many buyers are cautious about submitting credit card information to foreign merchants’ websites.

Homegrown Japanese Mobile Payments

Mobile payments are quickly becoming the new go-to for Japanese eCommerce. Two major players in particular, PayPay and Rakuten Pay, are dominating the space. With over 60 million registered users, PayPay is the top QR wallet in Japan. Supermarkets and restaurants accept PayPay, and eCommerce checkout integration is quickly rising.

A major allure of PayPay is its points-back system, where users get points for every purchase they make that they can then spend elsewhere. If your checkout offers PayPay, knowing how many points a customer can earn for their purchase can be just as enticing, if not more so, than offering a discount.

While more robust than most realize, Rakuten is most known by outsiders as the main Japanese eCommerce competitor to Amazon. The company’s payment hub, Rakuten Pay, offers “Rakuten Super Points,” the most well-known loyalty currency in the country.

Users earn a certain percentage of points for each purchase, which can be boosted by other factors, such as using Rakuten-issued credit cards. Like PayPay, users can spend Rakuten Pay points elsewhere, so they’ll be more apt to make a purchase online if they see the logo on your website.

How to Integrate Japanese eCommerce Payment Options

Now that you know the most popular online payment methods, it’s time to learn how to utilize them to confirm a sale.

- COD and konbini payments – These are typically easy to implement if your site is built using Shopify, Wix or WooCommerce and are shipping domestically in Japan. If shipping from from outside the country, you’ll need to utilize third-party proxy services like Rakuten Global Express.

- Credit cards – To get over that trust hurdle, prominently display familiar credit card logos that you accept. As a pro-tip, the JCB logo in particular signals local compatibility. Using Japanese-language SSL/secure payment icons can also help. Finally, make it clear you support cardholder authentication services (本人認証サービス), which Japanese customers see as a protection. Even just having other Japanese-only payment options available can reduce the perception of risk in using credit cards.

- Mobile/digital wallets – There is a psychology behind PayPay and Rakuten Pay. Loyalty programs are habit-forming. Once a customer is locked in with a certain payment ecosystem, they’ll want to stay there. Surveys show that over 70% of Japanese consumers consider point accumulation when deciding where to shop online. Given that number, digital wallets like PayPay and Rakuten Pay are a no-brainer for integration.

Let ICJ Guide Your Japanese eCommerce Journey

At ICJ, we can advise you on how to implement Japanese payment options. Creating and/or localizing a website, including pricing, can help ease the concerns of Japanese customers buying from foreign brands. We know how to optimize your website strategically to accommodate Japanese online shopping sensibilities.

We understand the Japan consumer mindset, and can guide you through the pitfalls and hurdles of Japanese eCommerce.